Commercial Banks’ exposure to GoG Bonds and T-Bills

Introduction: On 5 December 2022, the government of Ghana through the Ministry of Finance announced the domestic debt exchange programme (DDEP) as part of its measures to address the rising and unsustainable debt levels accrued in recent years. This became necessary due to the lack of access to the international bonds market (following the downgrade by some international credit rating agencies) coupled with the structural weakness of the Ghanaian economy given its susceptibility to local and global shocks, among others. The DDEP is also a precondition to assessing the IMF bailout to address the balance of payment challenges as indicated by government.

The DDEP is an invitation to bondholders to exchange their domestic notes and bonds of the Republic of Ghana, ESLA Plc, and Daakye Trust Plc for new bonds with new interest and new payment duration. By this proposal, government is in technical default of payment and seeking to salvage the situation. However, the way and manner government is implementing the process has irked several stakeholders, chiefly blaming government’s lack of meaningful consultation and dialogue with the affected bondholders.

It should be noted that debt exchange programme is not a new phenomenon and have been implemented either via a coercive approach (as in Greece with the passage of a law) or a voluntary approach (as in the case of Jamaica). Some countries that adopted the voluntary approach had several stakeholder engagements often spanning several months to address critical issues of concern. The case of Ghana employs more or less of both the voluntary and coercive approaches, given the short deadlines and lack of consultation to address the teething issues.

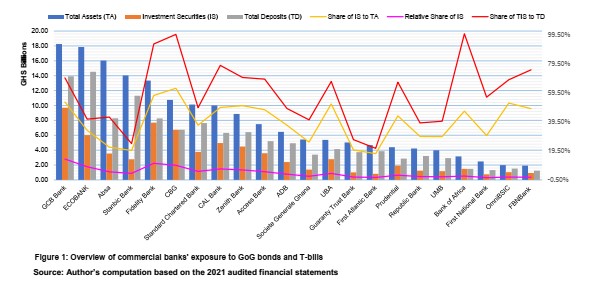

In this Chamber Economic Alert, the attention is focused on the level of exposure of commercial banks to government bonds and treasury bills and their implication for the wider economy. The analysis, as presented in Figure 1, is based on the 2021 audited financial statements of the 22 commercial banks operating in the country.

Analysis: The 22 commercial banks hold a total asset of GHS 175.89 billion with total deposits at GHS 123.20 billion and investment securities at GHS 70.16 billion. Customer deposits account for 94.2 percent of total deposits with the remaining held by other banks (5.8%). Also, total deposits account for 70 percent of total assets. About 40 percent of total assets are held as total investment securities in government bonds and treasury bills. Five of the commercial banks (GCB Bank, Ecobank, Absa, Stanbic Bank, and Fidelity Bank) hold 45.2 percent of the industry total assets with each bank holding in excess of GHS13 billion.

In addition, six of the commercial banks (CBG, Fidelity Bank, GCB Bank, OmniBSIC, UBA, and Zenith Bank) have over 50 percent of their total assets held as investment securities. This suggests that over 50 percent of the total assets of these six commercial banks are exposed to government bonds and treasury bills which is beyond the industry average (39.9%). A further probe showed that six of the commercial banks (Bank of Africa, CBG, Fidelity Bank, Cal Bank, FBNBank, and Zenith Bank) have over 70 percent of their total deposits exposed to investment securities in government bonds and treasury bills which is beyond the industry average (56.95%).

Across the industry, the level of exposure to government bonds and securities is mostly (56%) spread in these six commercial banks: GCB Bank (13.84%); Fidelity Bank (10.96%); CBG (9.6%); Ecobank (8.57%); Cal Bank (7.05%); and Zenith Bank (6.4%). Eight of the commercial banks have less than two percent level of exposure to government bonds and treasury bills which include Societe General Ghana, Republic Bank, UMB, OmniBSIC, Guaranty Trust Bank, FBNBank, First Atlantic Bank, First National Bank.