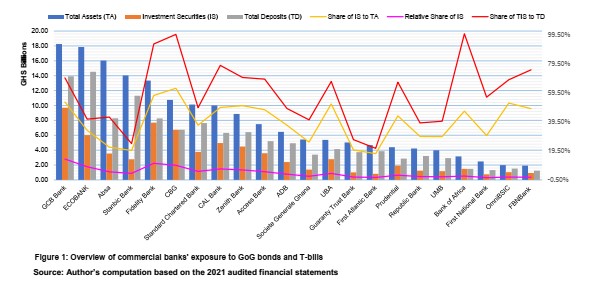

Conclusion: Customer deposits form a significant portion of commercial banks’ total deposits in Ghana underlying their financial intermediary role. Total deposits account for less than three-quarter of total assets. About 40 percent of total assets are held as investment securities in government bonds and treasury bills. The analysis also showed that a little over a half of total deposits are exposed to investment securities in government bonds and treasury bills. Three out of the five commercial banks with high asset value are mostly exposed to government bonds and treasury bills.

Implication: A minimum two-thirds of total deposits are exposed to government bonds and treasury bills across half of the commercial banks. Similarly, majority of the banks have over 39 percent of their total assets exposed to government bonds and treasury bills. Commercial banks operating beyond the industry averages would be severely impacted by the DDEP depending on their resilience.

Recommendation: While appreciating the exigency of the DDEP, government must ensure that it has adequately engaged affected bondholders to address their concerns regarding the current form and manner of the implementation to minimise the inherent losses. The failure to meet the initial deadline and the subsequent revisions underscore the overly fixation on the end-result rather than the process thereof.

Government’s action must not be seen as punitive to those individual bondholders who chose to have confidence in the Ghanaian economy but rather winning back their confidence. Moreso, the past 12 months have seen heightened challenges amidst global disruptions and uncertainties with businesses bearing the brunt of global and local shocks; thus, testing their resilience and sustainability. Striking a delicate balance to mitigate the inherent losses with the corresponding adjustments in fiscal and monetary policies will be decisive in the way forward.

Commercial banks must adopt innovative ways to cushion customer deposits and strengthen their portfolio diversification along productive sectors of the economy to sustain business growth and value. The Ghana NationalChamber of Commerce & Industry (GNCCI) will continue to engage government and other stakeholders towards a successful implementation of the DDEP with mitigated impact on the financial sector and the wider economy.

Click to download (The Chamber Economic Alert Issue No. 3 January 2023 – Finale.pdf)